Industry-Specialized

M&A Experts

Businesses Sold

In-Network

Exit Value Created

by Network

Exitwise M&A Industry Specialists

Put More Money in Your Pocket.

Founders who try to sell alone or rely on generalist M&A advisors often fail to sell or they leave millions on the table. Our model empowers visionary founders to build elite, industry-specific M&A teams that unlock full company value and deliver the exit our clients truly deserve.

Our Concierge M&A Service

Has You Covered at Every Stage.

Whatever your exit requires, we make it effortless to engage the right experts, exactly when and how you need them.

M&A Team Selection

Provides the most vetted and successful M&A experts at every stage of your M&A process...

Exitwise provides the most vetted and successful M&A experts at every stage of your M&A process to ensure you maximize your professional, financial and personal outcome when selling your business.

Company Preparation

Prepare and assemble your company’s historical financials, financial projections, corporate documents, and more...

Exitwise can help prepare and assemble your company’s historical financials, financial projections, organizational charts, employment agreements and corporate documents so you ready to talk with buyers

Transaction Support

Leadership, education, buyer introductions, market research, valuations opinions and emotional support until the sale...

Exitwise will support you and your M&A team with education, buyer introductions, market research, valuations opinions and emotional support until the sale of your business has completed.

The Exitwise™ Difference

Whether you're considering a traditional investment bank, a broker, or going it alone—there’s a reason more founders are choosing ExitWise. Here’s how we compare to other options when it comes to trust, expertise, and real outcomes.

.png)

.png)

Founders Helping Founders

We’re not your typical M&A team of bankers and brokers. We’re exited founders who’ve made it our mission to ensure no founder has to brave the exit process blind, uncertain, or alone.

.png)

.png)

.png)

A Track Record Built on Trust

We measure success in outcomes—and in the trust founders place in us. Explore the companies we’ve helped exit and the impact we've made.

Previous Transactions

These are just a few of the exits we’ve had the privilege to guide. Each one represents a tailored process, a trusted relationship, and a founder-first approach.

.png)

Case Studies

What does a wise exit look like in action? These founder journeys reveal how clarity, strategy, and the right team can change everything.

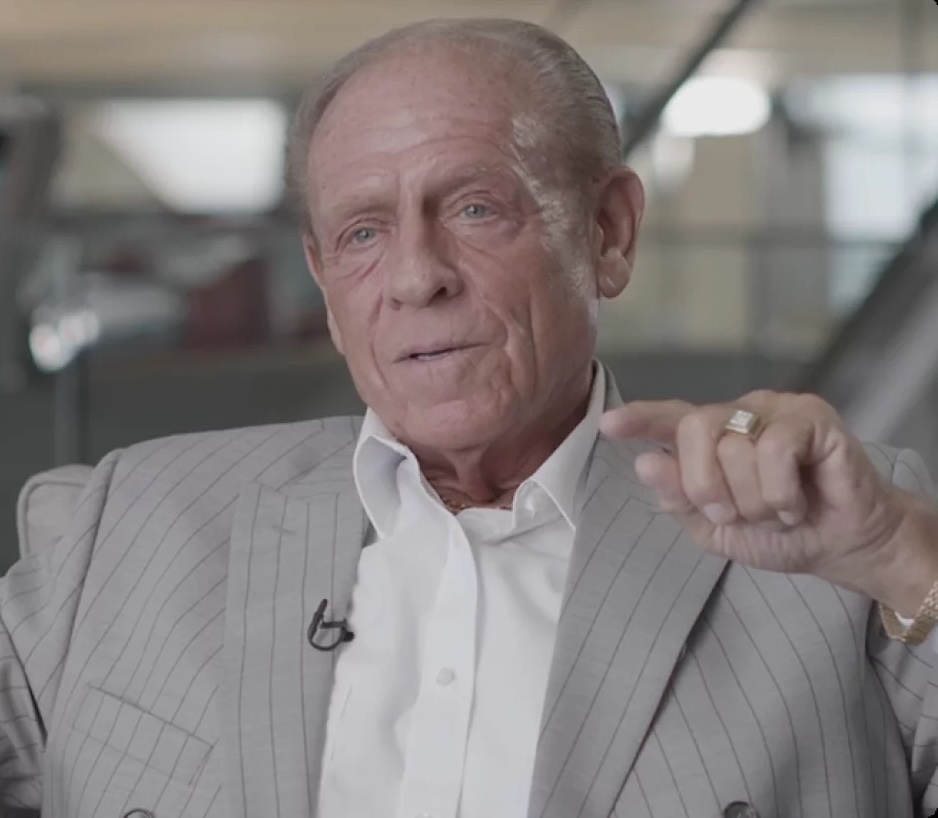

Testimonials

Exiting a business is personal. Here’s what real founders had to say about working with ExitWise—and why they’d do it again.

.jpeg)

.jpeg)

.png)

.png)