↑ 25%

Increase in Sales Price

Increase in Number of Offers

Increase In Success Rate

Faster to Exit

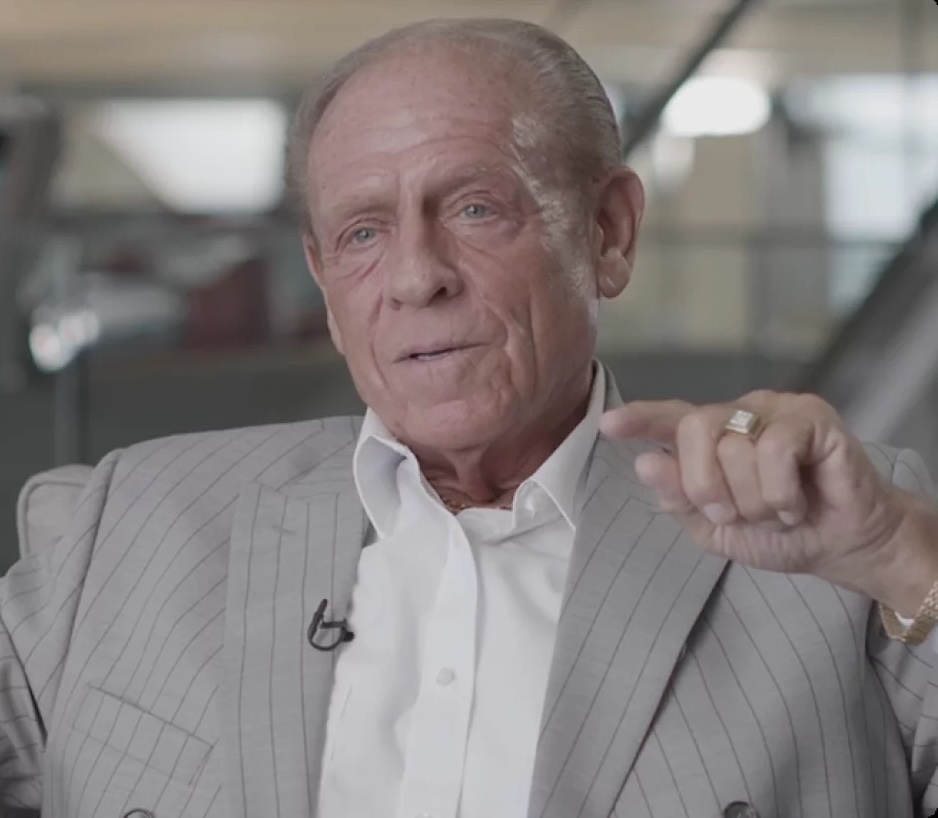

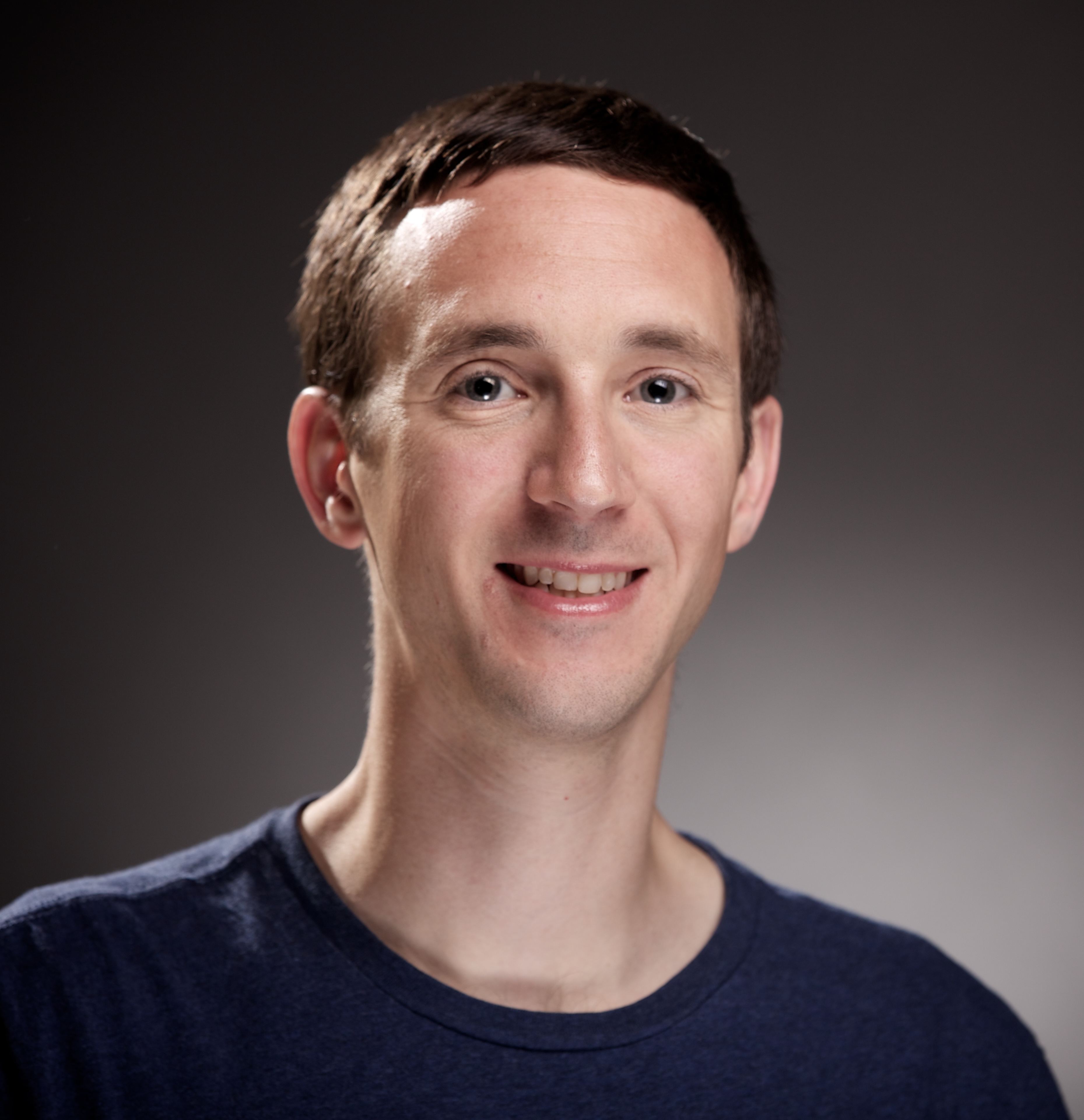

Featured Exited Founders

Each of our Exited Founders have all been through one or more of their own M&A transactions. They have been in your shoes and are here to help you maximize your exit.™

Exited Founder Benefits

Each Exited Founder offers personal M&A experience and deep professional networks in their respective industries to help you Maximize Your Exit.™

How to Engage an Exited Founder

Every Exited Founder’s goal is to make sure you create the exit you deserve. Engaging is easy!

Schedule a

Free Call

Exited Founder Interview

Hire Your

Exited Founder

Testimonials

Exiting a business is personal. Here’s what real founders had to say about working with ExitWise—and why they’d do it again.

Frequently Asked Questions

What is an Exited Founder?

An Exited Founder is an entrepreneur who has founded or cofounded a company and successfully exited his or her company through an IPO, M&A transaction, recapitalization or secondary share transaction. Exited Founders have joined ExitWise to help their fellow founders maximize their exits.

Why should I hire an Exited Founder to sell my business?

An Exited Founder brings expertise in building a company, M&A deal-making, a network of potential buyers, and experience navigating complex financial, legal and employment issues. An exited founder can not only be a great personal mentor during your exit process but can also help maximize your company's sale price, reduce risks, and ensure a smoother transaction.

What services do Exited Founders provide during the sale process?

Exited Founders typically offer:

- M&A education Founder Mentorship

- Business valuation advice

- Access to top M&A experts to build your M&A team

- Incredible personal networks with strategic investors and buyers in their industry

- Negotiation skills with potential buyers

- Deal structuring and transaction experience

- Advise on Coordination of legal, financial, and tax professionals

- Assistance with due diligence

- Advice on major personal and professional decisions throughout the M&A process

How does an Exited Founder help with the valuation of my company?

Our Exited Founders have free access to Exitwise valuation services and have visibility into private transaction data in their industry. Exited founders assist investment bankers that use various methods, such as comparable company analysis, discounted cash flow analysis, and market trends, to assess the value of your business. Exited Founded can also factor in your industry dynamics and your growth potential to help negotiate an optimal sale price on your behalf.

What should I consider when choosing an Exited Founder?

Industry experience: Ensure they have exited a business in your sector.

Track record: Ask about their personal exits and how they have helped other business owners with M&A.

Network: A strong personal and professional network of potential buyers is key.

Communication: Choose someone you can trust and communicate with easily.

Industry Stature: Exited founders bring different levels of credibility to your team which can have a dramatic effect on how buyers value your business.

How long does it take to sell a business with an Exited Founder?

The process can take anywhere from 6 to 12 months or longer, depending on market conditions, the size of your company, and the complexity of the transaction. Exited Founders absolutely help expedite the process.

.webp)

.svg.png)